Convertible Loan Note (US) with Legal Review & Advice

$285.00

The Convertible Loan Note (US) is a legal agreement that formalizes a loan arrangement between an investor and a company, allowing the loan amount to potentially convert into equity under specified conditions. The document provides a flexible financing mechanism tailored for early-stage or growth-stage companies seeking to raise capital without immediately setting a valuation.

Product Features

- This document is available in Word and PDF formats.

- Includes a set of drafting tips and instructions to assist you with customizing the document for your specific needs.

- Includes a 30-minute online consultation for the review of the document by a lawyer.

- Access to the calendar for scheduling the online consultation shall be made available upon purchase.

To obtain the best results from your online consultation, please email the completed document to be reviewed to info@us.entrep.legal at least 24 hours prior to the consultation.

9999 in stock

Description

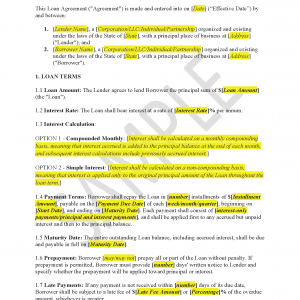

Key Features of the Document

- Loan Terms:

- Specifies the loan amount, interest rate, and maturity date.

- Details the accrual and payment of interest, including provisions for compounding if the loan is not repaid or converted by the maturity date.

- Conversion into Equity:

- Defines “Conversion Events,” such as equity financing, merger, acquisition, IPO, or maturity.

- Includes terms for automatic or elective conversion of the loan into company shares, often at a discounted price or based on a valuation cap.

- Investor Protections:

- Grants rights to monitor the company’s performance through financial updates and, optionally, observer rights at board meetings.

- Includes representations and warranties from both parties to ensure legal compliance and protect against misrepresentation.

- Use of Funds:

- Restricts the use of loan proceeds to approved purposes, typically general working capital or other agreed-upon expenditures.

- Repayment and Prepayment:

- Limits early repayment by the company to safeguard the investor’s opportunity for conversion.

- Includes a “usury savings clause” to ensure compliance with applicable interest rate laws.

Purpose and Use

This Convertible Loan Note is commonly used in startup financing or early-stage investment scenarios. It provides businesses with immediate funding while deferring equity valuation discussions. For investors, it offers the potential to convert the loan into equity at favorable terms during significant growth or liquidity events. The document balances flexibility with protections for both the company and the investor.

Related products

-

- Business Formation and Partnerships Set-up Related, Content Creator and Influencer Related, Employment and HR Related, Finance and Investment Related, IP Protection Related, Manufacturing and Distribution Related, Sale of Goods and Services Related, Website and E-Commerce Related

Document Review Consultation

- $250.00

- Add to cart

Reviews

There are no reviews yet.